Legal & General

Redefinging the digital landscape for personal investing at L&G

I led the end-to-end redesign of Legal & General’s personal investments digital customer experience, from persuasive, high-converting webpages to seamless quote-and-apply journeys, and intuitive investment selection tools — ensuring every touchpoint empowered users to find the right products with confidence.

Tailored Investment Guidance - each customer requires a different level of support when selecting investment funds. Our responsibility is to guide them appropriately, ensuring they’re not exposed to unnecessary risk.

Whether switching from a default fund to a self-selected multi-fund portfolio or making an initial choice, customers needed clear, comparable information to make confident decisions.

This case study covers the simple fund selection tools. The more advanced portfolio options, I designed will be added in later.

Services:

Lead UX, Content design

The problem

Aimed at novice investors, both the ISA and personal pension allowed a customer to select one fund based on risk appetite for their money.

There was no way for an investor to quickly compare each fund inorder to decide which was right for their needs. As well as this, after opening an account and as a customer became more confident with their choices there was no way to change the fund that they were invested in.

The existing fund selection tool on L&G.com

Even though customers find the tool easy to use within the application process for an ISA / personal pension the feedback was that it could be improved to aid a customers’ ability to select the right fund.

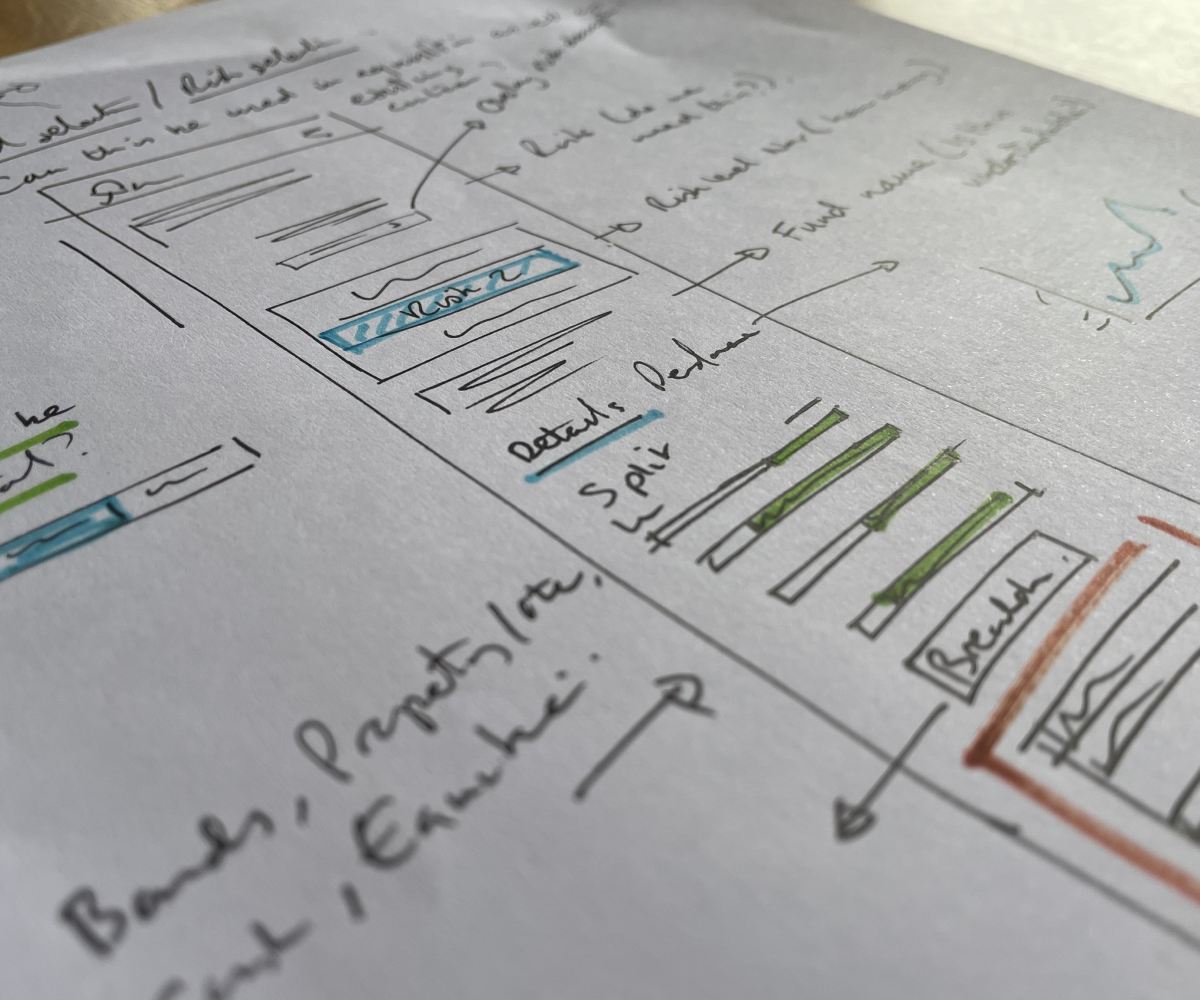

The process of discovery

After running a series of surveys and user tests to find what information was critical to making a decision and competitor analysis on similar propositions to understand the market, we had a baseline of features and information that we could begin to design with.

Description

Investment split

Performance

Fact sheets and Investor documentation

Split breakdown - stretch target

Top 10 holdings - stretch target

Geographical holdings - stretch target

Projected value and calculator - stretch target

Financial advice - not in the pipeline yet

Testing fund descriptions

To make it simpler for a customer to select the right fund we tested a few options using plain English and metaphors to describe different risk levels of the funds.

Relating the funds back to value to make it easy for as a customer to understand how different risk levels might affect their investments.

Option 01 - Value

Option 02 - Walking

Using the metaphor of walking across different terrains to explain risk with the levels of difficulty and undulating paths relating to the peaks and troughs of investing.

Option 03 - Food

The most ambiguous of the three…

Thinking about the different types of cooking, using simple, easy to prepare predictable microwave meals vs home-prepared food from the garden which takes more effort.

In context

These descriptions were then tested in the context of the fund selection journey. We also used these sessions to gauge feedback on features that we were thinking of developing, such as projected value.

Feedback

We showed the test participants the three variations of the copy for the fund risk level description and asked them to vote on which was the most helpful when deciding on a risk level.

Option 01 (Value): 20 Votes

Option 02 (Walking): 8 votes

Option 03 (Food): 2 votes

Simplified choice and fund switch tool

Mobile first tool that allows customers to not only choose their funds based on risk but switch from one fund to another. To be used across acquisition and existing customer journeys across all of L&Gs personal investing products.

The outcome

Live on the Personal pension account page and is being launched with other digital products and journeys this year.

Current feedback has been positive from customers.